The Single Strategy To Use For Best Broker For Forex Trading

Table of ContentsA Biased View of Best Broker For Forex TradingNot known Details About Best Broker For Forex Trading Best Broker For Forex Trading Can Be Fun For EveryoneUnknown Facts About Best Broker For Forex TradingSee This Report on Best Broker For Forex Trading

Considering that Forex markets have such a big spread and are used by a massive variety of individuals, they supply high liquidity on the other hand with other markets. The Foreign exchange trading market is constantly running, and many thanks to modern technology, is accessible from anywhere. Therefore, liquidity describes the fact that anyone can purchase or market with a simple click of a switch.Therefore, there is constantly a possible merchant waiting to buy or offer making Forex a fluid market. Price volatility is one of one of the most important variables that aid determine on the next trading step. For temporary Foreign exchange investors, cost volatility is vital, because it portrays the hourly adjustments in an asset's worth.

For lasting investors when they trade Forex, the cost volatility of the market is also essential. One more substantial advantage of Forex is hedging that can be used to your trading account.

Rumored Buzz on Best Broker For Forex Trading

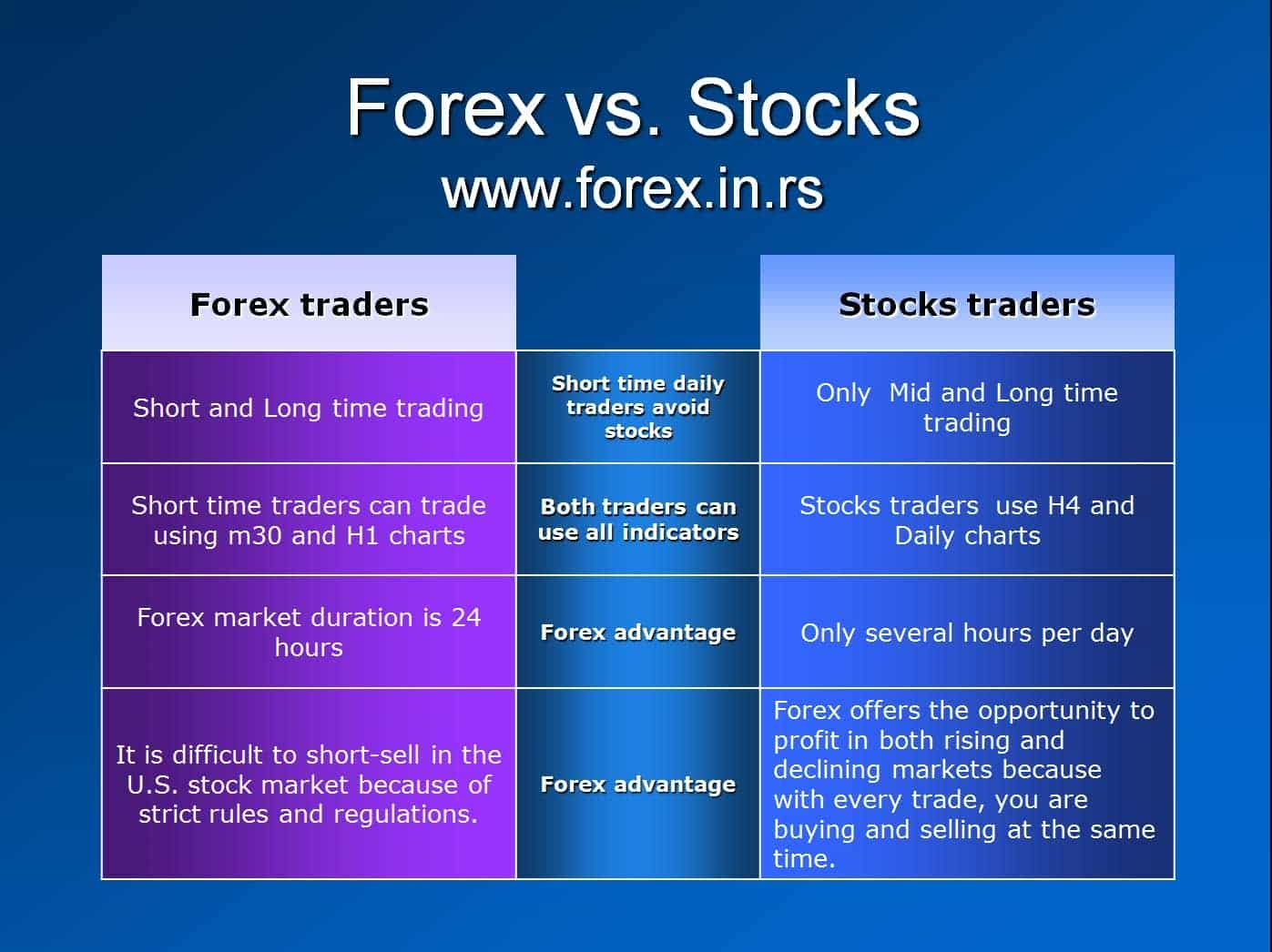

Depending on the moment and effort, investors can be split into categories according to their trading style. Several of them are the following: Forex trading can be successfully applied in any one of the methods above. Due to the Foreign exchange market's terrific volume and its high liquidity, it's possible to get in or exit the market any type of time.

Forex trading is a decentralized technology that functions without any central monitoring. That's why it is more vulnerable to fraud and other sorts of risky activities such as deceptive guarantees, extreme high threat degrees, etc. Therefore, Forex law was created to develop an honest and ethical trading top article perspective. A foreign Forex broker must abide with the criteria that are defined by the Forex regulator.

Thus, all the deals can be made from anywhere, and considering that it is open 1 day a day, it can also be done any time of the day. For instance, if an investor is situated in Europe, he can trade throughout North America hours and keep an eye on the relocations of the one money he has an interest in (Best Broker For Forex Trading).

How Best Broker For Forex Trading can Save You Time, Stress, and Money.

A lot of Foreign exchange brokers can provide an extremely reduced spread and decrease or also get rid of the trader's expenses. Capitalists that select the Foreign exchange market can increase their income by staying clear of fees from exchanges, deposits, and various other trading activities which have extra retail purchase expenses in the supply market.

It offers the alternative to enter the market with a little spending plan and profession with high-value money. Some investors may not satisfy the needs of high utilize at the end of the transaction.

Forex trading may have trading terms to protect the market individuals, yet there is the threat that right here a person might not appreciate the agreed contract. The Forex market functions 24 hours without stopping.

When retail traders describe rate volatility in Foreign exchange, they indicate exactly how big the upswings and drop-offs of a money pair are for a details duration. The larger those ups and downs are, the greater the price volatility - Best Broker For Forex Trading. Those large modifications can evoke a sense of unpredictability, and often traders consider them as a possibility for high profits.

9 Simple Techniques For Best Broker For Forex Trading

Several of the most unstable currency pairs are thought about to be the following: The Forex market offers a great deal of benefits to any kind of Foreign exchange investor. As soon as having actually decided to trade on international exchange, both skilled and newbies need to specify their economic technique and get acquainted with the conditions.

The content of this article reflects the writer's point of view and does not necessarily reflect the main setting of LiteFinance broker. The product published on this web page is attended to informative purposes just and must not be thought about as the arrangement of investment advice for the purposes of Directive 2014/65/EU. According to copyright law, this post is considered copyright, that includes a prohibition on copying and distributing it without permission.

If your business does business internationally, it is essential to recognize just how the worth of the united state buck, about other money, can dramatically impact the price of items for united state importers and exporters.

7 Easy Facts About Best Broker For Forex Trading Explained

In the early 19th century, currency exchange was a huge part of the procedures of Alex. Brown & Sons, the very first investment bank in the United States. The Bretton Woods Agreement in 1944 needed currencies to be fixed to the United States dollar, which was in turn pegged to the price of gold.